Fintech companies generate and process huge amounts of sensitive data. From users’ financial information and credit history to compliance reporting and monitoring, the fintech industry relies on data as its main asset.

This is collected, stored, and analyzed to stay in line with regulations, enable day-to-day operations, and provide better services. Effective and secure data management is critical for fintechs to assess risk, remain compliant, and transform raw numbers into insights that fuel business growth.

In a recent Forbes Insights report, 83% of executives agree that improving data management will help their company improve customer services and outperform competitors.

On the opposite end, neglecting data management can lead to poor business decisions, or even worse, security breaches that undermine users’ trust and undo years of your company’s work. To unlock the power of data and lay the ground for a risk-free approach, fintech companies should adopt effective data management practices.

What is data management in fintech?

Fintech data management is the end-to-end process that allows financial technology companies to gain a trustworthy and consolidated view of their data. It’s a multifaceted approach that involves not only collecting and storing data but also using it to generate business intelligence, adhere to regulatory standards, and maintain user privacy and app security.

Managing this data requires data processing, analytics, and automation capabilities, as well as expertise in areas like cybersecurity, cloud computing, Big Data, and Data Science.

Transitioning to more efficient data management workflows is no simple task. However, a reliable software development partner can provide the technical support to meet your evolving data governance needs.

Key data challenges faced by fintech companies

With fintech as one of our main areas of expertise, we have extensive experience in building custom solutions for the finance sector. Part of this process involves diving deep into the challenges our clients face to help us make the best engineering decisions.

As our experience shows, financial technology companies often have similar data-related struggles.

Data integration challenges

Once at the periphery of the financial world, fintechs are now gradually finding themselves at the center of this sector. This means they need to accommodate exponential growth in data coming from multiple sources, including banks, payment processors, and other third-party APIs.

However, integration issues don’t stop at the diversity of data sources. Legacy systems add another layer of complexity. Many financial institutions still rely on outdated technologies that are not designed to interact with modern, cloud-based solutions.

As reported, 57% of practitioners say data from legacy systems is hard to access for cloud analytics, so they avoid adding it to their pipelines. This is a risky strategy since legacy systems hold decades of valuable business logic and customer insights.

Data quality challenges

Another significant obstacle for financial institutions is the quality and consistency of their data. Poor data quality can jeopardize not only their ability to make good business decisions or fight financial crime but also to provide accurate risk assessments.

There are plenty of real-life examples of how data quality issues can have a notable material impact. For example, the Bank of England was fined £44m due to poor data quality and several longstanding deficiencies in its data governance.

Fixing issues created by poor data quality can leave companies looking for the needle in the haystack in the absence of automated solutions. The sheer diversity of financial data formats also increases this challenge, as companies need to bring together data from different sources into a common standard.

Data security and compliance challenges

Data security and compliance are top priorities for fintech companies. According to the Bank for International Settlements, the financial sector is the most targeted by hackers, after healthcare. The reason is, of course, the wealth of valuable data that can be sold by attackers at exorbitant prices or exploited through ransomware.

As fintechs are partnering with other companies to improve digital services, these vulnerabilities can quickly spread, increasing the risk of data loss or misuse due to the sharing of customer profiles.

Without a solid data management strategy, compliance also becomes a major concern. Compliance refers to the steps organizations must take to adhere to regulatory laws regarding data privacy, consumer security, and the use of financial technology in general. As data moves between jurisdictions, fintechs need to put in place lawful transfer mechanisms across borders.

Performance and scalability challenges

Fintech companies face a unique difficulty not only due to the volume of data they handle but also due to its velocity. To be valuable, transactions, customer interactions, or market data need to be processed in real-time or near-real-time. This places a significant strain on infrastructure performance, which needs to support and balance high data loads at incredible speed.

Big data is a new aspect of data management that executives and analysts are increasingly considering. Working with big data comes with its own set of problems, including creating an environment that can ingest, store, process, and visualize big data. Data lakes, BI tools, and software like Amazon S3 and Hadoop are becoming integral to enterprise data strategies.

6 points for secure and efficient fintech data management

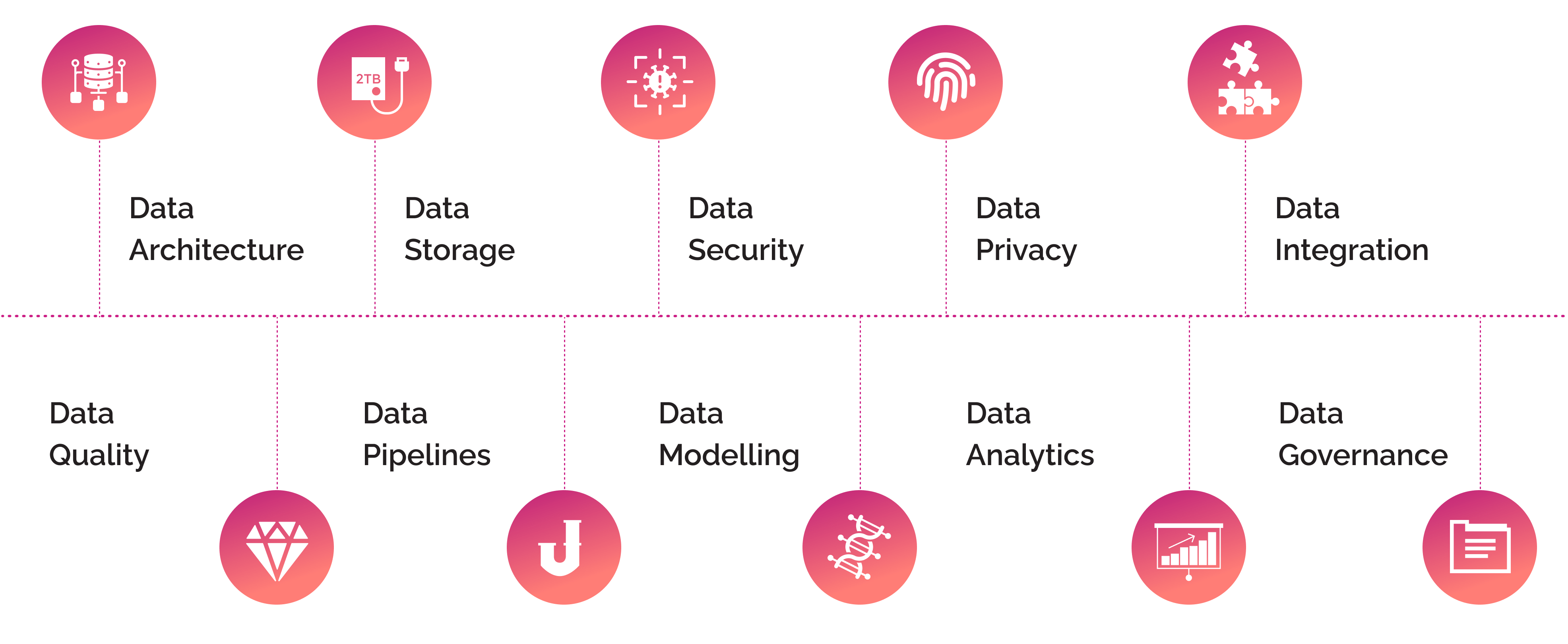

Modern data management requires fintechs to take into account a variety of aspects that range from cybersecurity and efficient data storage to powerful analytics.

Here are some key considerations for managing data in the fintech industry.

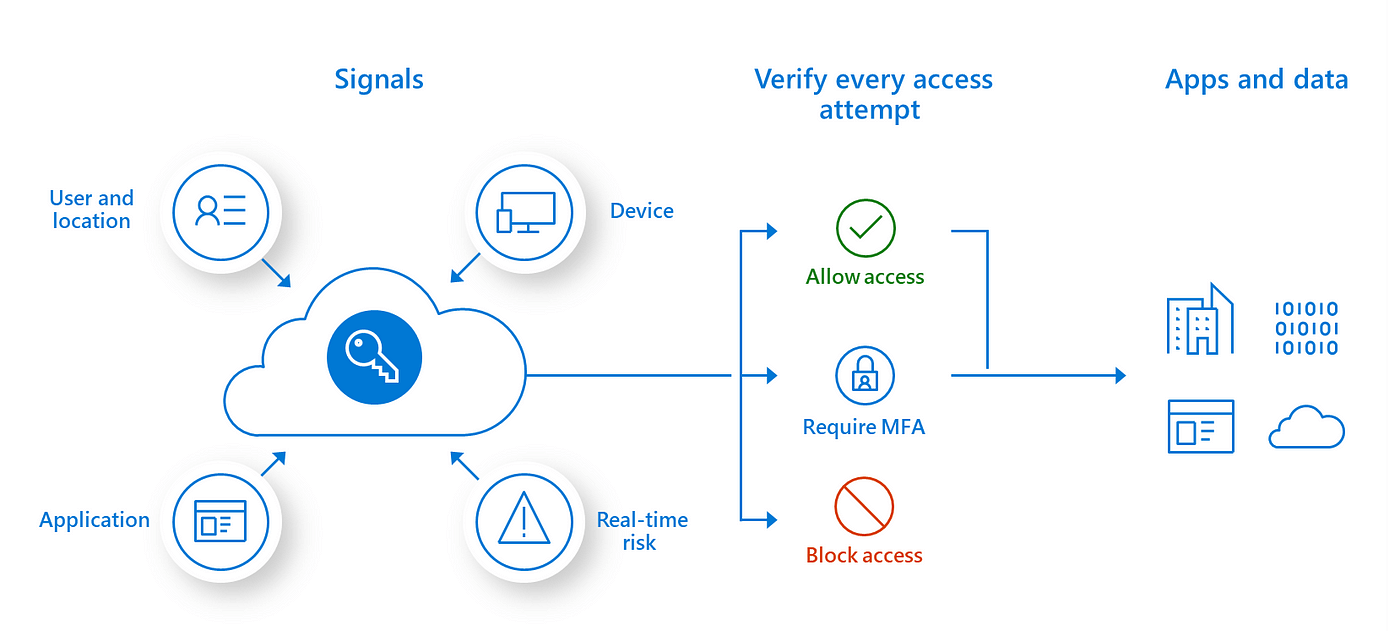

Adopt a Zero Trust security model

The Zero Trust model works on the principle of "never trust, always verify", meaning that users, devices, and applications should always be verified before giving them access to sensitive data.

As financial regulators implement frameworks that require increasing transparency and accountability, such as GDPR, PSD2, or MiFID, fintechs face the pressing need for a robust yet adaptive security architecture.

Zero Trust relies on a combination of advanced technologies, including multi-factor authentication, identity verification, endpoint security, and automated threat detection.

These are some of the ways you can use a Zero Trust approach to reinforce financial data protection:

-

Identity and Access Management (IAM): IAM is a must if you want to ensure that only authorized users can access confidential data. This enables fintech companies to regulate access based on users’ roles and limit the potential damage that can be done.

-

Network segmentation: Network segmentation is another way to prevent the risk of widespread data breaches by creating secure zones in your network that isolate critical systems.

-

Data encryption: Through encryption, your data becomes unreadable and therefore unusable by attackers. Encrypting data when it’s stored (at rest) and when it's being transmitted across networks (in transit) is equally important.

-

Continuous monitoring and end-to-end visibility: Zero Trust mandates real-time visibility into fintech applications, from user activity down to end-point behavior and API security. Observability tools play a key role in automating real-time monitoring, threat detection, and response.

Source: Principles of the Zero Trust Model

Migrate data to the cloud

The cloud is changing how financial data is collected, stored, and processed, with many fintechs shifting to cloud-based solutions to cut down costs, improve performance, and overcome legacy infrastructure challenges.

According to McKinsey, 54% of financial institutions expect to shift at least half of their workloads to the public cloud within 5 years.

Autoscaling is a huge advantage that allows companies to quickly accommodate high workloads by enlisting additional cloud resources. Once the workload decreases, they can scale down without having to pay for unnecessary bandwidth. This means fintechs can pay only for what they use, while still being ready to adjust capacity as needed.

The rise of the industry-specific cloud is another influencing factor with IBM Cloud for Financial Services being just one example. Industry cloud platforms offer a variety of services and tools designed to address specific industry use cases, from regulatory compliance to managing data protection across multiple jurisdictions. With data in the cloud, financial organizations can access better data visualization, self-service analytics, and AI and ML technologies for automated monitoring and faster insights.

Optimize storage for big data with data lakes

Financial organizations store structured, unstructured, and semi-structured data in large volumes, with data coming from multiple sources at high speeds. Unlike traditional storage solutions such as warehouses which focus mostly on structured data, with data lakes you can store a wide variety of data types in their native formats.

There are several reasons why financial institutions choose to use a data lake, including:

-

Centralized repository: Companies can combine all types of data in a centralized repository that allows for quick data retrieval and analysis. This reduces the cost associated with maintaining separate storage solutions for different data types and makes compliance tracking easier.

-

Big data support: Data lakes are easier to integrate with advanced analytics and Machine Learning tools, allowing data scientists to perform big data analysis and even train algorithms on large amounts of data for improved forecasting.

-

Deeper business and customer insights: With the help of data lakes, financial institutions can gain more far-reaching insights than what could be achieved by analyzing only structured data.

Implement robust data governance

As a fintech, collecting and storing data responsibly is a must. To provide better services and remain competitive, fintechs are gathering an increasing amount of customer information, but sometimes this poses governance issues.

Data governance keeps fintech companies accountable by verifying the accuracy and compliance of the data.

An approach we follow is to incorporate data governance practices throughout the development lifecycle. Robust data governance is a core component of effective data management and fintech software development. We work closely with our clients to ensure their fintech product uses clean, reliable data and follows data stewardship and privacy best practices.

For example, when using real data in development, testing, or staging environments, we use masking techniques to protect sensitive information. Similarly, we work to determine if the app will touch any existing customer data and what type of new data it generates. This allows us to understand who controls the data, engage all the necessary stakeholders, and work together to document any governance rules the development team needs.

Improve data quality with Machine Learning

Validating data and fixing errors is essential for maintaining a reliable knowledge base, but this can be extremely time-consuming.

75% of data professionals say it takes four or more hours to detect data quality issues and about nine hours to solve them. As support agents enter data manually, it’s not uncommon to have incomplete addresses or misspelled names.

Machine Learning automates a lot of the data quality processes involved in a financial organization’s day-to-day operations like reconciliation, assessing missing data, cleaning data, or correcting errors. By using Machine Learning companies can create their own data quality rules and be instantly alerted when incoming data may pose certain concerns.

Furthermore, they can take this logic and apply it at scale, without having to write business rules that address each dataset.

Integrate AI-powered analytics and visualization

A big part of fintech data management is being able to gain clear, actionable insights from your data.

But AI-powered analytics goes beyond extracting and analyzing data. It uses advanced algorithms to identify patterns in customer behavior, markets, and financial indicators and make accurate predictions.

Predictive modeling enables financial companies to proactively detect suspicious financial activity, make better credit scoring and investment decisions, and optimize their portfolio performance.

AI also plays a crucial role in real-time analytics and event processing. Financial organizations collect and analyze data continuously, with AI unlocking new opportunities to capture insights and take instant action on data flowing into your organization.

Similarly, visualization allows financial teams to dive into data through user-friendly reports, charts, and dashboards. Combined with data mining, machine learning, and other techniques like predictive modeling, visualization gives fintechs a powerful tool that allows to quickly interpret complex data sets.

Final thoughts

Robust data management is essential for fintech companies to secure their customer’s information, comply with regulations, make data-driven business decisions, and stay ahead of the game.

To be truly effective, data management practices should be implemented throughout each step, from the early stages of developing your fintech application to using technologies like AI and ML to take charge of your data and make decisions with confidence.

At ETEAM we specialize in helping financial technology companies leverage the best combination of technologies to overcome data challenges and reach their goals. From app security best practices and big data storage to data pipelines and advanced analytics and visualization, our team of engineers and data scientists excels at working with data to empower fintechs.