The fintech industry has been evolving before our eyes ever since banks went online. With such rapid growth, industry stakeholders cannot help but ask themselves: have most innovations in fintech already occurred or should we expect more to come?

Fintech has transformed how financial services work and how accessible and convenient they are. If you ever made a virtual deposit, used a budgeting app, or sent

money to a friend, you have witnessed some of its power.

With a predicted growth of 6x in the next decade, the story of the fintech industry seems to have just begun. So, in what ways will it continue to revolutionize how we understand and use financial services? Before diving into predictions, let's take a quick look at the state of things today.

Looking back. A brief fintech industry overview

Fintech explained

Fintech is a blanket term for all the ways technology is used to enhance, automate and simplify financial services and processes. It can refer to both the applications like mobile banking and investment apps or technology companies developing such solutions.

Dating back to the first ATMs and bank mainframe computers, the term was initially applied to the technology used by financial institutions. However, this gradually shifted to consumer-oriented services, which is now the main focus.

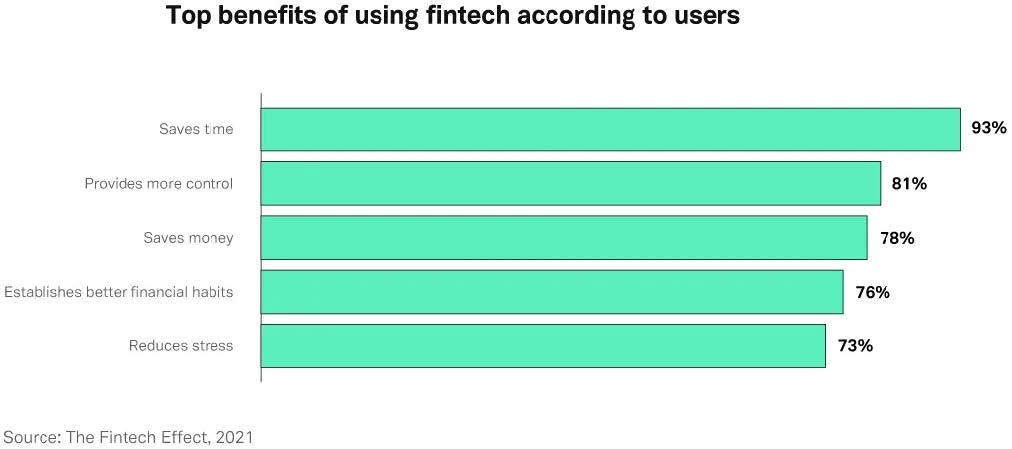

According to Plaid`s Fintech Effect report, fintech is currently used more widely than

social media, with over 88% of US consumers employing technology to manage their

finances. This makes it one of the most widely adopted consumer technologies. The

reported benefits of using such digital tools include saving time, more control over

finances and less stress.

Types of fintech solutions

The fintech landscape is complex, with emerging startups and disruptive technologies

on the one hand and traditional financial institutions on the other hand. As banks and

other traditional institutions are adopting fintech services for their own purposes, the question arises: Will banks remain the biggest players or will they be replaced by tech

companies?

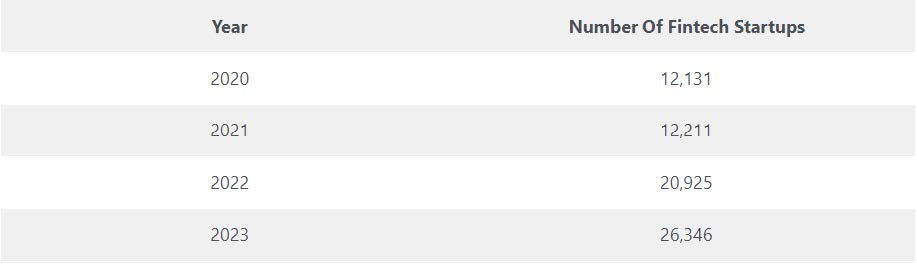

The number of fintech startups has more than doubled worldwide in only three years,

from 12,131 startups in 2020 to 26,346 in 2023. Global funding has also reached a

record $132 billion in 2021, an indication of broad interest in the industry, with some of the most popular types of fintech-as-a-service including:

- Payments: Payments fintech companies leverage technology to offer seamless,

secure, and convenient payment experiences for businesses and consumers.Armatic is one of the platforms that offer automated payments and billing, including automated follow-up emails for late-paying clients, and synchronization with accounting software.

- Budgeting apps/personal financial management: These services allow users to

manage, budget, and make sense of their money, including understanding their income and spending behavior. - Consumer banking and investment: Things like opening an account, making online deposits, or investing your funds intelligently with the help of a robo-advisor, are made easy by companies in this niche.

- Digital lending & leasing: Such companies use digital tools, data analytics, and

automation to streamline and enhance the lending and leasing processes. - Open banking: These solutions enable the sharing of financial data between different financial institutions and authorized third-party providers through APIs.

TrustLoop is an elegant open banking solution that gives access to a broad range of high-quality financial data from banks across Europe through a single API.

Source: https://www.demandsage.com/fintech-startups-statistics/

Technologies powering fintech today

Also called the ABCD of fintech, the four main technologies that power the industry

today are: AI, blockchain, cloud computing, and big data. Some of the most common AI

applications include fraud detection, credit scoring, and chatbots or visual assistants.

Since it's able to analyze large volumes of data and identify patterns, AI is a great way

to get insight into consumer behavior, and spending habits and also predict future risks.

Similarly, big data analytics help companies predict changes in the market and create

new, data-driven business strategies. From cryptocurrencies to cross-border payments, blockchain eliminates the need for intermediaries, making financial transactions more decentralized. Last but not least, cloud computing offers a scalable and cost-effective infrastructure for fintech companies, allowing them to store and process large amounts of data securely.

Looking forward. What should consumers, business owners, and fintech companies expect in 2030

Trends in fintech continue to evolve. According to experts, we can expect to see a

number of shifts in how consumers, business owners, and top fintech companies

understand and use financial services in the next decade.

For consumers

The decline of cash and in-person transactions

There has been a lot of speculation about a cashless society. As cash has fallen from

its undisputed position as the primary payment method, this begs the question: will it still be around in 2030?

While cash may not disappear completely, digital payments are becoming the primary

mode of transaction, leveraging advanced payment technologies like mobile wallets, QR codes, and biometric authentication. In 2020, cash represented only 20.5% of all POS transactions, a significant 32% drop from 2019, according to the Global Payments Report. This sets a telling trend, which will likely continue in the future as new technologies are invented and existing features like contactless payments or

peer-to-peer transfers are perfected.

Increasingly customizable and personalized experiences

From tailored financial products to voice and gesture-based interactions, the future of

consumer finance seems to be highly personalized. By leveraging artificial intelligence

and powerful algorithms, financial technology companies will have the means to

understand consumer behavior in all its complexity.

This will allow them to create increasingly custom experiences like financial advice

based on real-time data or contextual hints. For example, an app might provide

spending insights and recommendations based on a user's location, recent purchases,

or financial goals. Similarly, as language processing and gesture recognition continue to advance, users will be able to interact with financial apps and services in a more natural manner, using hand gestures and facial expressions.

Virtual and Augmented reality will be used more in financial services

AR and VR technologies have the potential to transform how consumers interact with

financial information. This ties in with a broader tendency towards gamification, as well as offering users a more personalized online experience. For example, using a combination of Augmented Reality and Chatbots can increase eCommerce client

retention, provide more custom content and get up to 10 times higher click-through-rate than standard content.

AR and VR are not only shaping the future of eCommerce, through things like virtual

shopping sessions, but they are also likely to influence how consumers use financial

services. This can range from virtual interactions with customer support representatives to virtual banking, trading, and investing or more immersive ways to visualize financial data and analytics.

Buy now, pay later will become the norm

More and more consumers are using buy now, pay later (BNPL) as a way to budget

their spending. This allows them to make purchases and defer the payment, usually in

installments, instead of paying the full amount upfront.

The growing popularity of BNPL can be attributed to several factors:

-

Many BNPL platforms have integrated their services with popular online retailers, making it easy for consumers to select this option during the checkout process. Since BNPL allows customers to order more, increasing the average order value, merchants have an extra incentive to promote this service.

-

BNPL offers consumers convenience and flexibility in managing their finances, easing the financial burden and enabling budgeting over time.

-

BNPL provides an alternative to traditional credit cards and loans, without the need for a credit check or lengthy approval process.

For business owners

Financial business reputation will become increasingly important

How do you know if a potential business partner is trustworthy? You could look at

third-party data from banks and external institutions. Or you could choose the most

telling evidence: their business and financial behavior.

Ratings are becoming increasingly important, with applications allowing businesses to

assess each other's level of commercial trust. Such applications can convert for example each confirmed payment into reputation points, which add up to a company's

reputation score. B2B rating apps are gradually becoming the number one way for

businesses to build their trust profile and mitigate risk when starting a business

relationship or negotiating a deal.

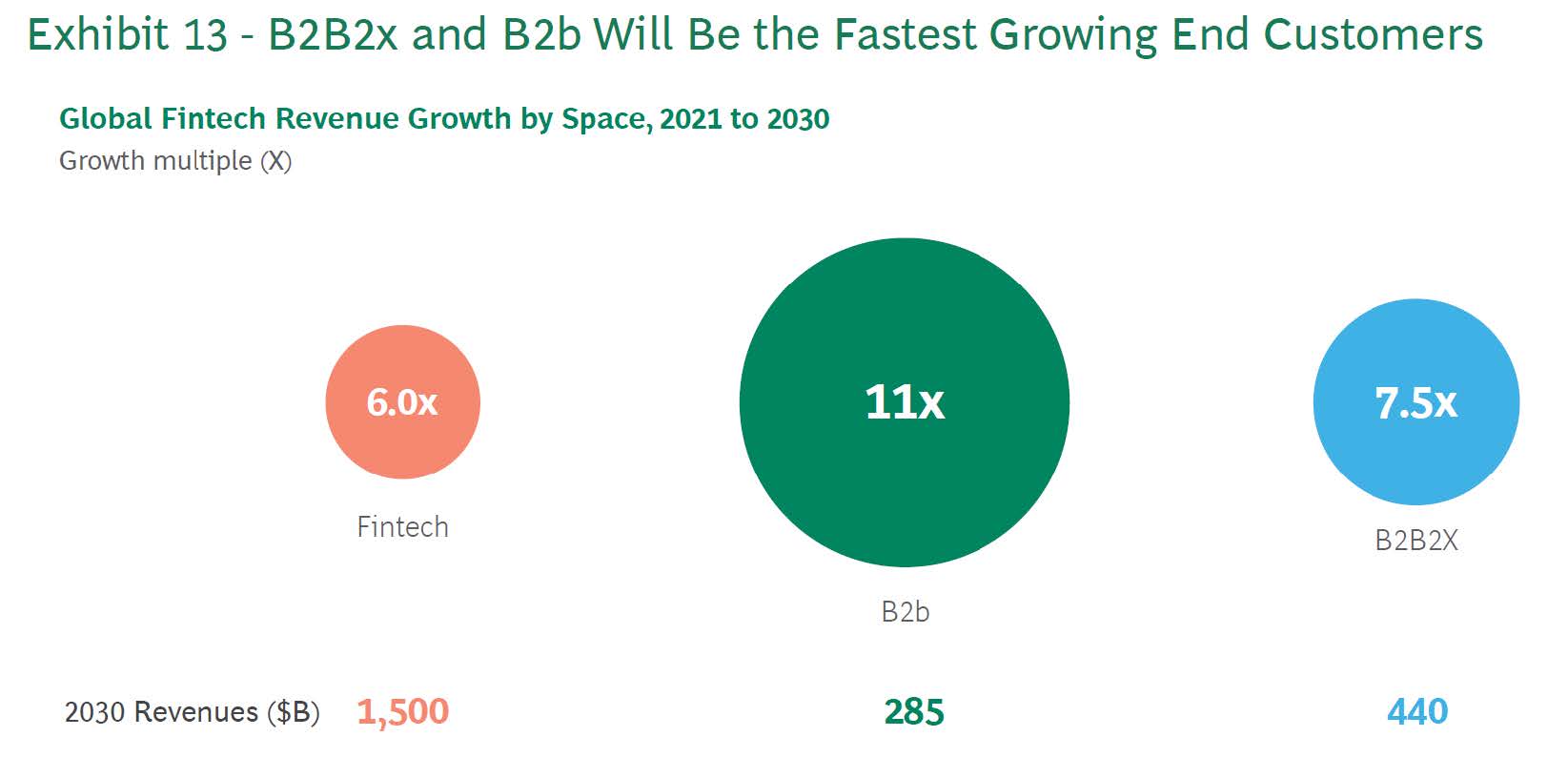

A shift from a business model based on payments to B2B and B2B2X

The first part of the fintech journey was mostly led by payments which represented 40% of all revenue in 2021, including sub-segments like cross-border payments and

real-time payments.

While payments will likely still account for a large portion of industry revenue, by 2030 B2B2X and B2b will be the fastest growing business models according to a BCG and QED Investors report. B2B2X, short for business-to-business-to-any, refers to service providers that contract other businesses (B2B) to deliver services to various end-users. B2b caters to small and medium businesses, representing a huge space for growth, as the most urgent concern of a lot of SMEs is accessing financing.

Source: BCG and QED Investors report

Decentralized financing for more accessible funding opportunities

Decentralized financing will allow business owners to access a more diverse range of

funding opportunities. Businesses will be able to access loans, crowdfunding, and

investment opportunities directly from a decentralized network of individual investors, bypassing traditional financial intermediaries.

Online lending platforms will also continue to gain popularity, offering alternative sources of funding for businesses. These platforms leverage technology to streamline the loan application and approval process, opening up new avenues for financing in addition to decentralized networks of investors.

Integrated fintech solutions + automation = increased efficiency

As fintech becomes more and more a part of daily business operations, business owners will have access to comprehensive platforms that combine accounting, invoicing, payroll, and financial planning tools in a unified interface. These integrated platforms offer seamless solutions for financial management, payments, and banking.

By combining these integrated solutions with Robotic Process Automation (RPA), businesses will be able to automate repetitive administrative tasks and free up more time and resources. Managing all financial operations in one place combined with using RPA to mitigate human error, can help business owners increase efficiency in an unprecedented way.

For fintech companies and fintech application developers

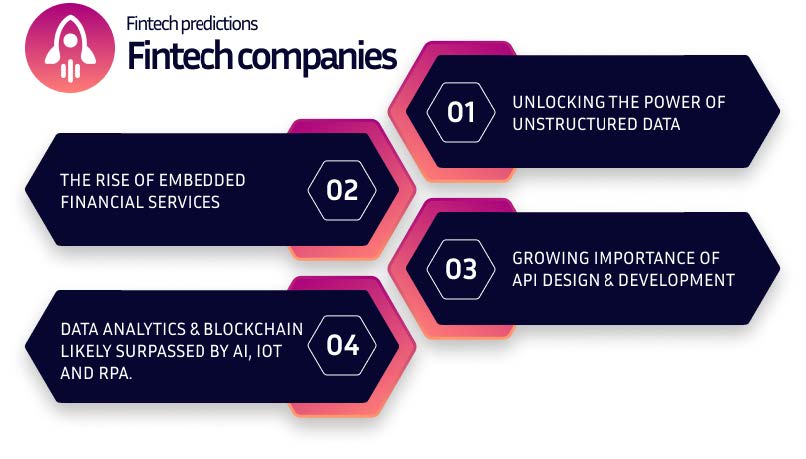

Unlocking the power of unstructured data

Unstructured data includes any type of data that doesn't fit into a traditional format

and can be easily stored in a database. Despite being more difficult to process and

analyze, unstructured data can provide additional information, context, and insight into consumer behavior. This makes unstructured data like customer support interactions and call center transcripts, emails, and online reviews, a valuable tool for improving and innovating financial services.

By tapping further into this potential in the future, financial software development

companies can use unstructured data to offer a more personalized customer experience. By performing sentiment analysis on sources like social media or customer reviews, fintech companies can gauge customer sentiment, identify emerging trends, and assess public perception of financial products or services.

The rise of centaurs. Embedded financial services

What if fintech will no longer be just fintech? Or, to put it otherwise, what if fintech will be everywhere? Embedded financial services seem to be the main direction in which the industry is heading, as more and more non-financial applications integrate financial services in some way or another. Money 20/20 managing editor Sanjib Kalita calls these emerging platforms “centaurs”. Similar to the mythical animal, half human, half beast, “centaurs” are half fintech and half something else.

Instead of relying on standalone financial applications, embedded financial services

enable users to access financial services directly within the platforms they are already

using. Some of the most common examples include ecommerce platforms or food

delivery services which allow users to make transactions or transfer funds without

leaving the platform. However, as embedded financial services extend, we will likely see fintech assimilating more and more niche services. This will give access to financial

services and payments in a seamless, almost invisible way.

Everything API

APIs play a key role in enabling connectivity and integration within the fintech

technology ecosystem. The importance of API design and development is likely to grow even more in the future, with open banking being one of the main driving factors.

As traditional banks are under constant pressure to compete with fintech companies,

open banking is an opportunity for them to join forces with the fintech industry and keep up the pace. Open banking promotes the secure sharing of financial data between banks and third-party developers through standardized APIs. These APIs allow financial technology companies to access customer account information, initiate payments, and develop innovative financial services that rely on data from banks or insurance companies.

Data analytics and blockchain will likely be surpassed by machine learning, IoT

and RPA

According to the “Fintech 2030: The Industry View” report, some of the most important technologies today like data analytics and blockchain will likely be surpassed by machine learning, IoT, and RPA. It's not that data will become less important, as the fall in data analytics would suggest, but data will be used more by algorithms, rather than humans. By feeding data into machine learning, IoT, and RPA algorithms, developers and fintech companies can improve customer experience, risk management, and decision-making processes.

Conclusion

One of the most pressing questions for stakeholders in the fintech industry relates to its future. Have most innovations in fintech already occurred or should we expect even more breakthroughs? Is fintech just a passing trend or is it truly a transformative force? From increasingly personalized user experiences and VR and AR innovations to smart solutions for business owners and the rise of embedded financial services, fintech seems like it's here to stay. Not only that, but it has the potential to shape a lot of our daily interactions and ways of understanding financial services.

At eTeam we believe the future is now. We`re excited to learn more about your project and help you prepare for the next stage in fintech innovation. We have experience working across a variety of fintech technologies, including consumer and business payments, open banking, and machine learning. Contact us right now and get a custom quote for your business.