One of the most important decisions any fintech startup has to make regards technology. Most companies decide on a tech stack very early in development, based on assumptions and incomplete research. This can lead to a lot of second-guessing later on.

Staying up to date with industry predictions is therefore essential in making the right choice. In this article, we`re going to look at popular tech stack options for fintech development based on the latest trends.

Why is tech stack important in fintech innovation?

A tech stack is a combination of technologies used for running and building applications. A well-chosen tech stack allows fintech companies to leverage trends to their advantage and to:

-

Use the latest frameworks, libraries, and tools to build innovative fintech products that meet user demands as they evolve.

-

Maintain a high level of performance while the user base grows and new features are added.

-

Reduce the risk of having to migrate to a better stack or get stuck with an outdated system.

-

Integrate the latest third-party services and emerging fintech technologies with no compatibility issues and easily swap components of the stack if needed.

Investing in the right tech stack has become a priority for companies who want to stay relevant and competitive. According to a Teradata study, 87% of technology decision-makers feel they are at risk of lagging if they fail to adopt technologies like AI, automation, or multi-cloud infrastructure.

How to decide on a tech stack for your fintech startup

Deciding on the best tech stack for your fintech is a balancing act. It requires both a thorough analysis of your current needs and a good understanding of upcoming trends.

1. Consider your focus and application features

One of the first things you need to consider is your project requirements, including your niche, the type of features included in the application, and their complexity. Some of the most popular types of fintech include banking, payments, and personal financial management, with regulatory apps and Insuretech also gaining traction in recent years.

While there isn`t a one-size-fits-all solution when it comes to building software, most fintech applications usually include at least some of this functionality:

-

A user dashboard that gathers financial data and reports

-

Some degree of automation

-

Push notifications

-

Digital payments or payment gateway

-

Security features that protect personal data

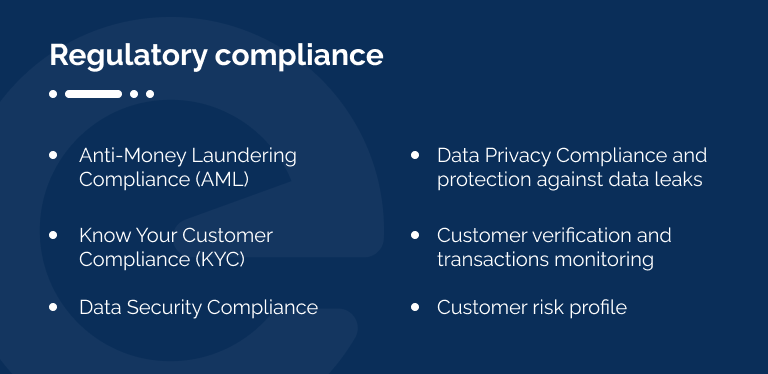

2. Check for regulatory compliance

Regulatory compliance helps protect both the users` interests and the business. Fintech companies are exposed to data breaches and money laundering risks, so securing your application against cyberattacks and fraud is essential.

When creating and implementing a financial software system, you must take into account the different regulatory guidelines and protocols and how your tech stack supports this.

For example, Artificial Intelligence and Machine Learning are often used to detect changes in behavior patterns that might indicate suspicious activities related to money laundering.

3. Prioritize security and scalability

Your tech stack of choice can also have a significant impact on security and scalability.

As fintech applications handle a lot of sensitive data, security is paramount. Technology directly influences the system's resilience and ability to withstand cyber threats and common vulnerabilities like SQL injections or cross-site scripting (XSS). Using frameworks with built-in security features, prioritizing data encryption, and including security-specific libraries in your tech stack can drastically reduce these risks from the start.

A well-designed tech stack also ensures your application can manage the increasing demands put on modern fintech systems. This may include processing high volumes of financial transactions or handling big data.

However, scalability is not only about quantity. By putting in place a solid infrastructure, fintech companies can focus on innovation rather than struggle to maintain a stable and responsive application.

Fintech industry trends to consider when choosing your tech stack

All-in-one fintech solutions

Also called super apps, all-in-one fintech solutions allow users to carry out different tasks and use a variety of financial tools without leaving the application. Everything is integrated within a single platform, which makes super apps highly convenient to use and customize.

Because they are modular and work across the web and mobile, super apps are likely to grow in popularity and incorporate further technologies and services.

Tech stack implications: All-in-one fintech solutions require a modular and flexible tech stack, which can allow for seamless updates and third-party integrations. Since their goal is to provide everything the user needs without switching applications, the tech stack should support cross-platform capabilities for a consistent user experience across the web, mobile, and desktop.

Chatbots, AI, and Machine Learning

AI and Machine Learning are transforming the fintech sector as we know it. Their range of use is ever-increasing, from risk assessment and predicting customer behavior to automating financial trading.

AI-powered chatbots are leading the way toward conversational banking, a form of digital banking that mimics real-life interactions and customer support through voice and text messaging.

Tech stack implications: Choosing a tech stack to accommodate AI and ML requires a solid strategy. This can mean either integrating cloud-based AI services or deploying and managing your own AI models, including model monitoring and retraining. Integrating chatbots also comes with certain challenges your tech stack needs to account for, like API security concerns and data protection.

Open banking and API-first software architecture

Open banking allows the secure sharing of financial data between banks and third parties through standardized APIs. As APIs play a key role in enabling connectivity and integration within the fintech ecosystem, the focus on API design and security will likely grow in the future, with open banking being one of the driving factors.

Tech stack implications: An API-first software architecture puts API design and security at the forefront. A well-structured tech stack allows developers to design APIs that are easy to maintain and expand, while also reinforcing security best practices through encryption, API gateways, and industry standards like OAuth 2.0, OpenID Connect, and OWASP API Security.

Cloud-native development

Fintech companies are leveraging cloud-native development to build scalable and agile fintech solutions that can adapt to changing markets. Multi-cloud platforms are also on the rise, as they allow businesses to distribute workloads across different platforms.

Managing a multi-cloud environment can be complex and requires careful planning and coordination to ensure data integration, security, and cost optimization.

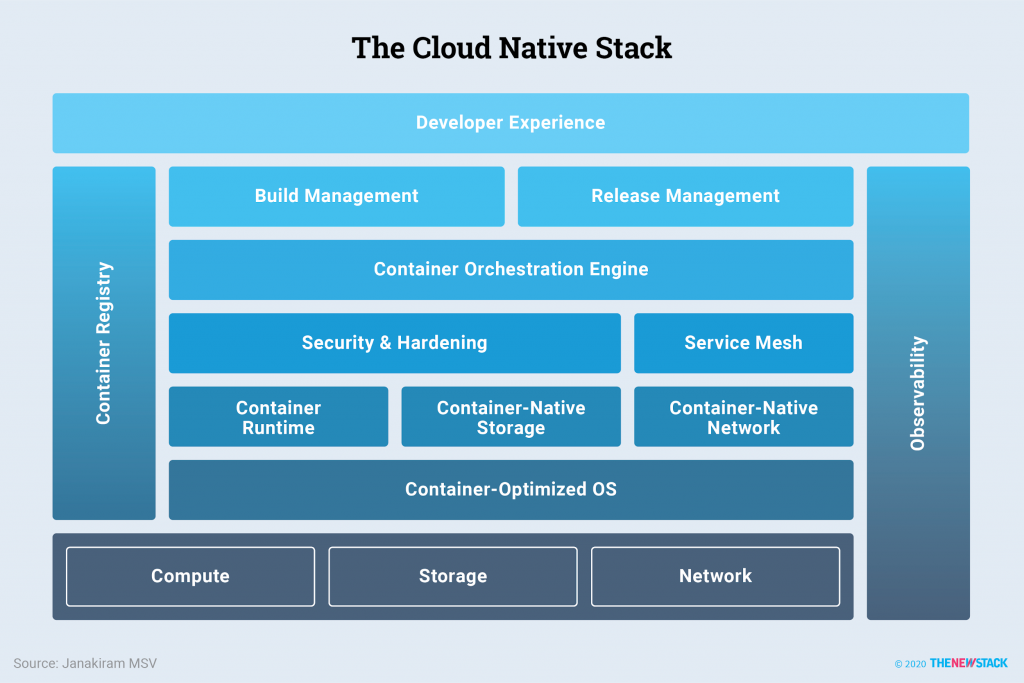

Tech stack implications: A cloud-native tech stack requires the careful orchestration of various resources and tools to build cloud-native applications, including storage and containers, continuous integration (CI), and continuous delivery (CD) tools or observability and monitoring.

Big data analytics

Fintech companies use vast amounts of structured and unstructured data to predict consumer behavior, understand market trends, and make decisions. As highly personalized products are becoming the norm rather than the exception, big data is here to stay as one of the main tools for understanding customer preferences and creating unique experiences.

Tech stack implications: Effective data management is essential for big data applications. The tech stack should include database systems that can handle large volumes of information efficiently and support data partitioning for improved scalability.

Top financial tech stacks in 2023

Keeping up with the latest industry developments requires a versatile tech stack that can match this dynamic environment.

1. Front-end technologies

The front-end layer is the part users see and interact with, making it a key aspect of any fintech application. Front-end technologies like JavaScript and JavaScript frameworks help developers provide a fast, responsive, and intuitive user experience. Some of the most popular JavaScript frameworks used in fintech development include:

-

React is a popular open-source JavaScript library for building interfaces based on reusable components. Preferred by many fintech developers for its ease of use and lightning-fast performance enabled by virtual DOM.

-

Angular is a front-end framework used for building dynamic and responsive UIs. Great fit for fintech development due to its focus on performance optimization, code maintainability, and scalability.

-

Vue is a JavaScript framework with a flexible architecture, which allows developers to extend, update and re-architect the frontend of their application without disruptions.

2. Back-end technologies

Fintech applications depend on back-end technologies to handle and process data, securely authenticate users, and provide the performance and speed needed for transactions and tasks. Choosing the right back-end technologies is key to building reliable, secure, and scalable software.

These are some of the top programming languages and back-end frameworks used in fintech development.

Programming languages

-

Java: Especially popular in large-scale banking applications due to its multithreading capabilities and efficient memory management. Java allows applications to support numerous transactions simultaneously, making it a great fit for financial institutions where speed and reliability are of the essence.

-

Python: Best known for its simplicity and rich library ecosystem. Python's clean syntax is easy to read and understand, making it less prone to costly coding errors. At the same time, Python's extensive machine learning and artificial intelligence libraries allow fintech companies to leverage powerful algorithms and solve data-intensive tasks.

-

C#: Object-oriented language used for building dynamic applications that run in the Microsoft .NET ecosystem. The .NET framework is common in enterprise-level applications requiring enhanced performance and high levels of security. According to a HackerRank survey, C# ranks among the top 5 languages preferred by fintech companies.

-

Node: Versatile runtime environment suited for building real-time and scalable financial applications. Node`s non-blocking, event-driven architecture allows applications to remain lightweight while handling a huge number of simultaneous connections.

Frameworks

Frameworks extend the capabilities of programming languages by providing an additional layer of abstraction and tools.

-

Spring Boot: An extension of the Spring Java framework, Spring Boot offers a comprehensive toolkit for fintech software development, from auto-configuration options to a microservices-friendly architecture. Spring Boot is a great fit for banking microservices, providing an easy way to create, tailor and deploy services for each specific banking function, from customer onboarding to compliance monitoring.

-

Django: A popular Python framework, Django comes with a lot of features useful in fintech development. Its built-in security features allow fintech companies to protect sensitive financial data and secure the application against vulnerabilities like XSS and CSRF. Django is particularly strong in building RESTful APIs. Django REST framework, a popular extension, makes it easy to integrate with third-party services, a key factor in keeping fintech applications competitive and scalable.

-

Flask: A more lightweight framework than Django, Flask is a good choice for fintech startups focused on quick prototyping and rapid application development. Flask`s minimalist approach and flexible architecture can significantly speed up development, while its countless libraries can easily extend functionality.

-

Express: A fast and unopinionated framework for Node.js, Express provides fintech developers with a host of tools for building robust financial solutions. In a landscape where real-time interactions are imperative, Express event-driven architecture enables developers to build interactive fintech applications that keep users engaged and updated.

3. Databases

Every second, fintech applications generate and process huge quantities of data. This wouldn't be possible without a robust database infrastructure that can store, manage and retrieve financial data. SQL and NoSQL are two of the most common types of databases, each featuring a distinct set of characteristics and use cases.

SQL Databases

SQL databases are relational, which means they come with a predefined schema and a table-based architecture. They work best for structured data, for example, financial data stored in a ledger that follows a certain categorization. Popular SQL databases include PostgreSQL, MySQL, and MS SQL Server.

Due to their tabular structure, SQL databases excel in scenarios where data consistency and complex querying are of the essence. For fintech applications dealing with critical financial data, SQL databases provide a well-defined schema that ensures data accuracy. Transactional data, user accounts, and historical data can be organized, queried, and updated with precision.

NoSQL Databases

Compared to SQL, NoSQL databases are non-relational, so they don't have a predefined schema and they work with documents and key-value pairs instead of tables.

This makes NoSQL databases like MongoDB or Cassandra, a great fit for storing and managing unstructured data.

Unstructured data includes any type of data that doesn't fit into a traditional format, like phone call transcripts, emails, video files, or images. Financial organizations often use unstructured data to understand user preferences and feedback and to improve and innovate their services based on this.

NoSQL databases also support horizontal scaling to handle large volumes of data, making them a good fit for intensive fintech applications.

4. Cloud providers

Cloud computing has opened a world of possibilities for fintech companies, allowing them to access, store, and process data without having to manage their own hardware or infrastructure. It also gave them a lot more processing power and fewer security concerns, making it easier to build and scale applications.

Here are the top 3 cloud providers that offer services tailored for Fintech like machine learning, data warehousing, and blockchain.

-

Amazon Web Services (AWS): In addition to computing, storage, and database management, AWS provides financial technology companies with a broad set of tools, including ML and AI services. Their Fintech Blueprint comes with a predefined set of configurations and settings that makes building and deploying fintech applications easier.

-

Google Cloud Platform: With a wide range of services, including AI/ML, data analytics, and big data tools, GCP empowers fintech developers to build resilient applications in the cloud. It provides a comprehensive platform combining advanced security measures and tailored solutions for financial services.

-

Microsoft Azure: Similar to AWS and GCP, Azure also provides capabilities to manage financial services data to scale, including workflow automation and intelligent tools to orchestrate processes.

5. Data Analytics and Machine Learning

Data Analytics and Machine Learning are two of the main driving forces in fintech today.

Data Analytics digs deep into financial data, uncovering insights that guide decision-makers.

Machine Learning gives an extra boost not only by making predictions and identifying patterns, but also by assisting in fraud detection, credit scoring, and risk management.

In this section, we`ll explore some of the tools that make this possible.

Processing large data sets

The ability to process terabytes worth of data isn`t just a matter of convenience, it's a necessity in the world of fintech. Big data analytics is used to analyze transactional data, customer behavior, and market trends and to provide business intelligence.

-

Apache Spark (big data processing): Apache Spark offers a powerful framework for big data processing, analytics, and machine learning. Fintech developers can harness Spark's parallel processing capabilities to perform complex data analyses, risk assessments, and predictive modeling.

-

Apache Hadoop (data storage and analysis): Apache Hadoop offers a distributed storage and processing framework that can be used to store historical financial data, perform analytics, and gain insights into market trends.

-

Apache Flink (stream processing): Real-time analytics and stream processing are integral to fintech operations. Apache Flink enables the analysis of continuous data streams for real-time fraud detection, payment processing, and customer engagement.

Implementing machine learning models

Machine learning libraries are an important tool for building and deploying machine learning models. Each library comes with its own strengths and capabilities, so it's important to select the ones that are the best fit for fintech software development.

-

Scikit-learn: Popular Python library for machine learning, offering a wide range of algorithms, such as regression and clustering, relevant for risk assessment and fraud detection tasks.

-

TensorFlow and PyTorch: Useful Python libraries for deep learning and neural networks. Can be used to build complex models for areas like algorithmic trading or sentiment analysis, an increasingly popular method for fintech companies to assess customer feedback.

6. APIs and integrations

The world of fintech is highly interconnected. Integrating fintech applications with external services like payment gateways requires careful consideration of the technology that is being used. RESTful APIs and GraphQL are two popular options for fintech developers to connect with other services.

RESTful APIs

RESTful APIs are well-established and widely used, with developers generally being quite familiar with their implementation.

REST allows for various data formats, such as JSON and XML, providing flexibility in data exchange. Most importantly, RESTful APIs can be scaled by distributing resources across multiple servers.

However, to gather related data, REST may require multiple requests, potentially impacting performance.

GraphQL

GraphQL allows clients to request precisely the data they need, minimizing over-fetching and under-fetching, two issues faced by RESTful APIs. Because it retrieves multiple types of data in a single request, GraphQL can reduce network round trips.

It also supports real-time subscriptions, enabling applications to receive updates when specific data changes.

Unlike RESTful APIs, GraphQL has a steeper learning curve and can sometimes lead to overly complex queries that strain server resources.

7. Security

Fintech applications are particularly exposed to the risk of sensitive financial information falling into the wrong hands. Incorporating security protocols and tools in your tech stack is of crucial importance.

Secure authentication and authorization

Two technologies that play a key role in ensuring secure authentication and authorization are OAuth (Open Authorization) and JWT (JSON Web Tokens). Combining OAuth and JWT provides a robust security foundation for fintech applications.

OAuth allows users to grant limited access to their accounts to third-party applications, enhancing data privacy and control over their financial information. OAuth also facilitates SSO capabilities, allowing users to access multiple fintech services with a single set of credentials.

In fintech applications, JWTs are commonly employed for implementing secure authorization mechanisms. Unauthorized modifications to the token content are easily detectable, which provides an extra security measure. JWTs efficiently encode data, making them suitable for transmitting authorization and user-related information between services.

Data security

HTTPS and TLS are two key components for securely transmitting financial information. Implementing HTTPS and TLS is a crucial step in meeting regulatory compliance standards and building user trust.

Encryption algorithms are also needed to ensure data is secure not only as it is transmitted over the Internet, but also at rest. Key encryption algorithms in fintech include:

-

Advanced Encryption Standard (AES) for protecting large columns of data,

-

Secure Hash Algorithm (SHA) for data integrity verification and digital signatures.

API security

APIs are the links that connect users, sensitive financial data, and fintech companies. This puts API security high up on the priority list when you are building your tech stack.

API security testing tools are essential in assessing the health of your API ecosystem. Tools like Sapience can automate API scanning for known vulnerabilities and generate comprehensive reports on found issues.

8. Compliance and regulation tools

Building your tech stack demands a strategic approach to address complex regulatory frameworks such as GDPR, PSD2, and local banking regulations.

Compliance and regulation tools can help fintech companies make sure they adhere to these requirements, regardless of their local jurisdiction, by enabling them to:

-

Implement mechanisms for user consent, data access requests, and data erasure to comply with GDPR.

-

Use automated KYC processes to verify customer identities.

-

Monitor financial transactions for suspicious activities and potential money laundering activities.

-

Capture user actions and system events, supporting compliance with data tracking requirements.

9. Microservices

Fintech applications often experience varying levels of user activity, especially during peak hours or market fluctuations. A financial tech stack should take into account a microservices-friendly architecture not only for performance reasons but also for scalability and maintenance.

Microservices architecture breaks down complex fintech applications into smaller, independent services, each responsible for a specific function. This modularity allows fintech developers to update, modify, and scale individual services without impacting the entire application.

Microservices also align seamlessly with agile development and DevOps practices, enabling frequent releases and continuous integration, two vital aspects in fintech's rapid-paced environment.

Conclusion

Choosing the right tech stack for your fintech is a decision with long-term consequences. It involves balancing a lot of aspects and staying up to date not only with regulations and requirements but also with industry trends and emerging technologies. Working with a development partner that understands the fintech industry in all of its complexity can help you overcome these challenges.